how long does the irs collect back taxes

Our Tax Relief Experts Have Resolved Billions in Tax Debt. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

How Long Can The Irs Attempt To Collect Unpaid Taxes

However if you are getting notices from the IRS and you are wondering if they will ever go away the answer is yes.

. 12 Years In Business. How long does the IRS have to collect back taxes. The IRS has not yet released its 2022 refund schedule but you can use the chart below to estimate when you may.

This time restriction is most commonly known as the statute of limitations. Under Federal law there is a time restriction on how long the IRS has to collect unpaid taxes. 3 Can IRS collect taxes from 10 years ago.

This 10-year period is called the statute of limitations on collections. Ad Owe back tax 10K-200K. Ad BBB Accredited A Rating.

6 What is the IRS 6. See if you Qualify for IRS Fresh Start Request Online. You May Qualify For This Special IRS Program.

Ad BBB Accredited A Rating. Owe IRS 10K-110K Back Taxes Check Eligibility. Unfiled Tax Return Help.

Whether the IRS is going to haunt them for the rest. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection. 2 Does the IRS forgive tax debt after 10 years.

See if you Qualify for IRS Fresh Start Request Online. End Your IRS Tax Problems - Free Consult. How long we have to collect taxes 3 How to appeal an IRS decision4.

Understanding collection actions 4 Collection actions in detail5. Owe IRS 10K-110K Back Taxes Check Eligibility. This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date they were.

Ad Owe back tax 10K-200K. Federal Tax Lien5 Notice of. 5 Does an IRS debt ever expire.

4 How far can the IRS go back to collect taxes. One of the first things people often wonder when they incur a tax liability is how long the IRS has to collect it. The IRS statute of limitations period for collection of taxes the IRS filing suit against the taxpayer to collect previously assessed taxes is generally ten years.

January 31 2020. As a general rule there is a ten year statute of limitations on IRS collections. End Your IRS Tax Problems.

There is an IRS statute of limitations on collecting taxes. This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date. By law the IRS only has ten years to collect the unpaid taxes from the time of the initial tax assessment.

Ad Owe 10K In IRS Back Taxes. As a general rule there is a ten year statute of limitations on IRS collections. The IRS has a 10-year statute of limitations during which they.

Ad Use our tax forgiveness calculator to estimate potential relief available. You cant calculate how far back the IRS can collect taxes without knowing when the countdown clock starts. If you dont pay on time.

The IRS 10 year statute of limitations starts on the day that your. There is an IRS statute of limitations on collecting taxes. End Your IRS Tax Problems - Free Consult.

The IRS started accepting 2021 tax returns on Jan. The IRS is limited to 10 years to collect back taxes after that. Get A Tax Analysis Consultation.

Ad As Heard on CNN.

Irs Tax Refund Identity Theft How It Can Happen To You Irs Taxes Tax Refund Identity Theft

Understanding The Irs Collections Process To Quickly Resolve Taxes Irs Collections Processes The Irs Has A Variety Of Tax Collect Irs Tax Help Tax Payment

Where To Start When Setting Up Your Business Part 2 Of 3 My Back Office Coach Small Business Accounting Money Basics Small Business Bookkeeping

How Far Back Can The Irs Collect Unfiled Taxes

A Brief Guide On How To Stop An Irs Levy Irs Tax Debt Irs Taxes

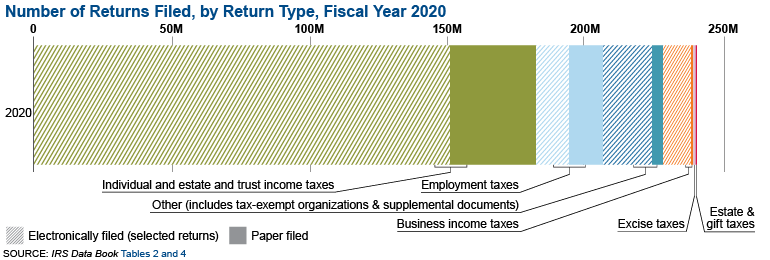

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

How Far Back Can The Irs Collect Unfiled Taxes

Know What To Expect During The Irs Collections Process Debt Com

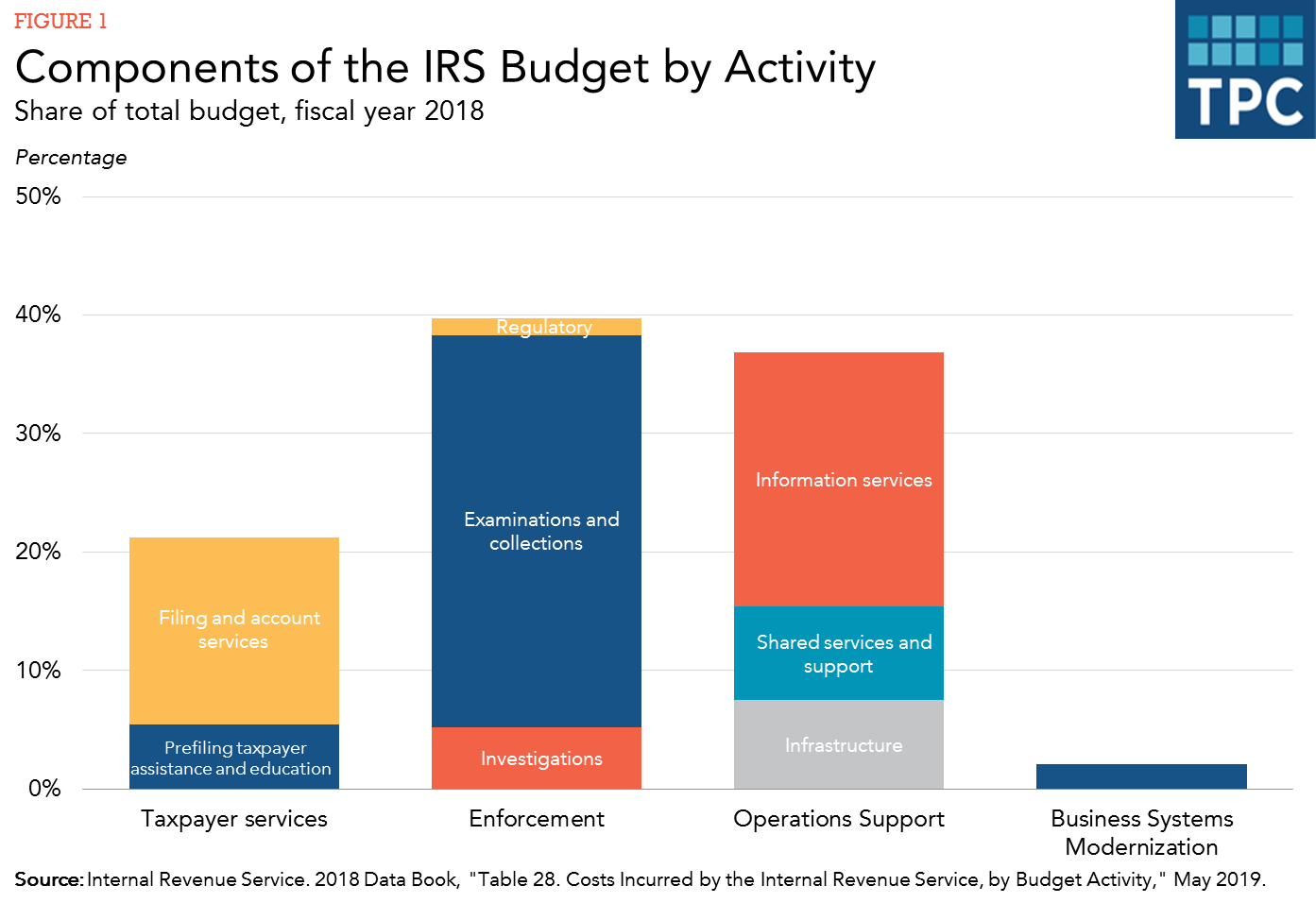

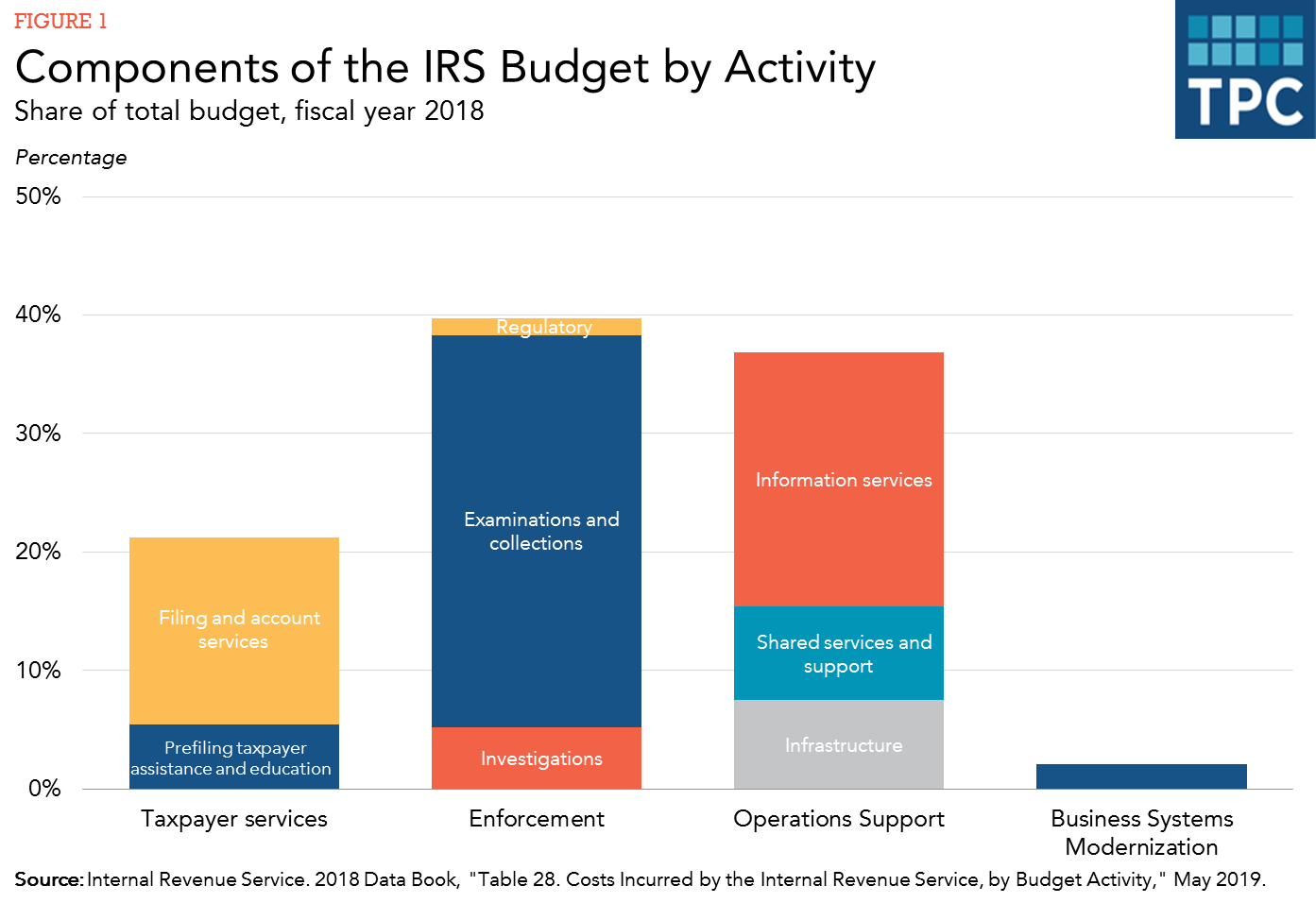

What Does The Irs Do And How Can It Be Improved Tax Policy Center

Find Best In Houston Tax Return Services Tax Return Income Tax Return Tax Attorney

The Federal Government Offers To Wipe Out Your Tax Debt Through New Irs Fresh Start Program Fresh Start Information Tax Debt Irs Start Program

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes

How Long Can The Irs Try To Collect A Debt

Irs Wage Garnishments El Paso Tx Villegas Law Cpa Firms Wage Garnishment Problem And Solution Irs

Does The Irs Forgive Tax Debt After 10 Years

If You Hold Crypto For Someone Else Can Irs Collect Taxes From You

The Irs Is Failing To Collect Billions In Back Taxes Owed By Super Rich Americans Practical Nursing Parenting Healthy Vegetables

Fillable Form 2290 2016 Power Of Attorney Form Irs Forms Fillable Forms